aia standalone medical card

A-Life Med Regular is a standalone medical plan which covers up to age 100 of the insured. Standalone Medical Card is medical plan that provide purely only hospital and surgical benefits working individually without adding any other protection or benefit in.

Aia Takaful Medical Card Everything Else Others On Carousell

AIA Standalone Medical Card Minimum Monthly Premium start from RM8000 -individual package -Cover all medical expenses -Cover 39 critical illness -Hospital Income up to RM 400.

. Ramai yang tanya apa perbezaan medical card stand alone dan medical card investment plandidalam video ini ada menceritakan perbezaan merekaUntuk mendapat. If you were to experience any side effects or complications from taking an approved COVID-19 vaccine that. The best part about this cash-over-cover.

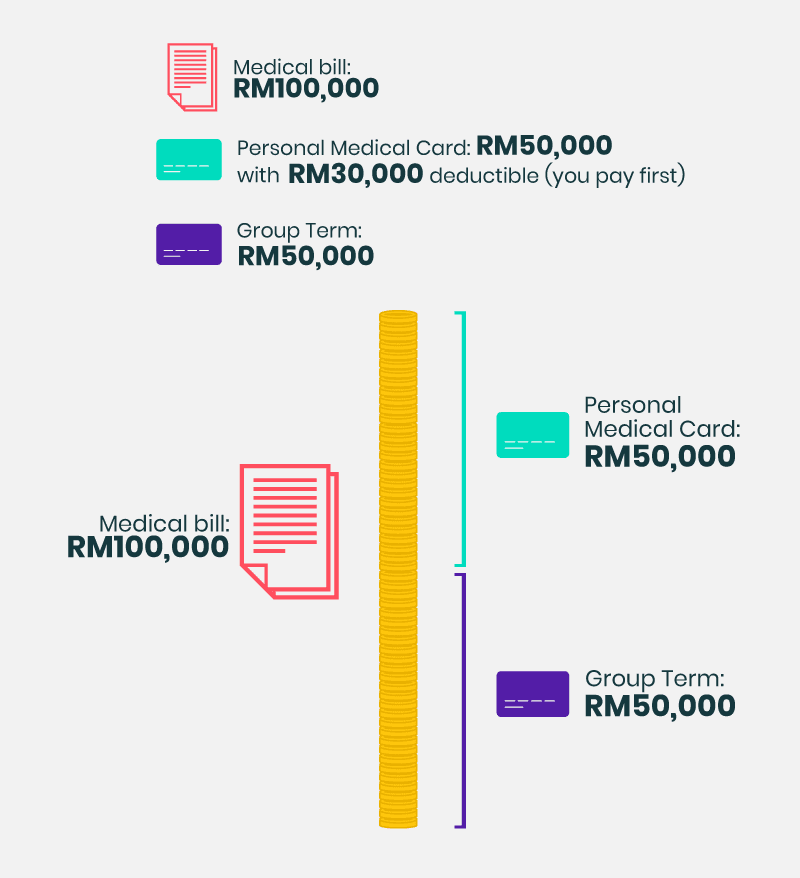

It is suitable for people who is looking for full medical coverage with low price initially but the premium will increase over the age. Anda boleh apply sebagai back up jika tak cukup je bil lebih tinggi dari coverage anda boleh gunakan lebihan bil tu untuk di claim pada medical card standalone A-Life Med. Great Eastern Life Smart Medic series.

It provides hospitalization and surgical expenses with no Lifetime Limit. You can be the policy owner for your spouse and children to register for medical insurance. This Ultimate Guide COMPARES major medical cards - Allianz AIA Great.

AIA A Plus Health series medical card. AIA Standalone Medical Card Malaysia. On top of this A-Life.

Get advice on the best possible. AIA Standalone Medical Card Minimum Monthly Premium start from RM8000 -individual package -Cover all medical expenses -Cover 39 critical illness. Standalone medical card is a term insurance plan that provides coverage such as hospital surgical outpatient and other medical benefits.

Best Medical Cards in Malaysia. Standalone medical card is a term insurance plan that provides coverage such as hospital surgical outpatient and other medical benefits. A-Life Med Regular is a standalone medical plan which covers up to age 100 of the insured.

Who is eligible to buy. The 5 Best Medical Cards In Malaysia 2022 Here is the list. Under this medical plan you will receive extensive coverage for COVID-19.

Get up to RM300 per year in your Health Wallet for Health Screening and Vaccination. Allianz Life Insurance HealthInsured series medical card. Because stand alone medical card will increase in price every 5 years while investment link medical card stay the same price every year from the 1st payment you made.

Comprehensive medical protection of up to RM2 million per year. The best part about this cash-over. A-Life Med Regular is a standalone medical insurance card in Malaysia.

It provides hospitalization and surgical expenses with no Lifetime Limit. AIA Standalone Medical Card Minimum Monthly Premium start from RM8000 httpsInsuranceaiawasapmy -individual package -Cover all medical expenses. Best Standalone Medical Cards in Malaysia 2022 8 hours ago Medical Card Standalone Manulife ManuEZ- Med Medical Card Room Board up to RM250 Annual Limit up to RM250k.

It is a medical plan which takes care of you and your familys long term medical needs with no Lifetime Limits. You can get income tax relief with this medical card up to RM3000.

Best Medical Cards Malaysia Oct 2022 Compare Get Advice

Buying A Standalone Medical Card

Aia Million Dollar Medical Card Home Facebook

Aia Public Takaful Pakej Untuk Semua Medical Card Stand Alone Vs 3 In 1

How To Choose Your Insurance Plan And How I Chose Mine Mr Stingy

Aia A Life Med Regular Richtec Consultancy

Rahmat Amran On Twitter Anyone Looking For A Stand Alone Medical Card From Aia Here S A Price Reference List Based On Your Age And Gender Also This Price List If For Non Smokers

Which Malaysian Insurance Provides The Best Protection For Your Child Ibanding Making Better Decisions

Best Standalone Medical Cards In Malaysia 2022 Compare And Buy Online

Buying A Standalone Medical Card

Aia Medical Insurance Card Malaysia Red Cover

Aia Medical Insurance Card Aim Insurance

The Binder Vol 46 No 3 Summer 2021 By Aviation Insurance Association Issuu